After taking the level 1 CFA exam, you will receive the results by email in eight to ten weeks. Although the multiple-choice format is normally associated with instant grading, the Institute takes extra time to ensure the fairness of the exam by assessing the difficulty level of questions and calibrating the minimum passing score (MPS). Waiting for the CFA results can be frustrating. To keep sane, we recommend treating that period as a Schrodinger’s cat situation, where you can assume you’ve passed until told otherwise.

When the results arrive, it is in a format that is informative but cryptic. The Institute has designed the CFA results to help the candidate understand the details of the performance, but also to hide the trade secrets of the material. The following guide will help you understand the report and offers advice on how to respond to a passing or a failing score.

Interpreting the score report

The report consists of two charts: (1), the overall performance and, (2) performance by topic:

Performance On the Exam:

The solid line above shows the total score, and the blue box surrounding it shows the expected range of scores were you to take the exam multiple times. This range accounts for random factors like comfort of exam conditions, lucky vs. unlucky guesswork, etc. The solid line is labeled “Minimum passing score” or MPS. The dotted lines show the 10th percentile (bottom 10%) and 90th percentile (top 10%) scores of the total population of that exam cycle. This report shows an impressive passing score near the 90th percentile.

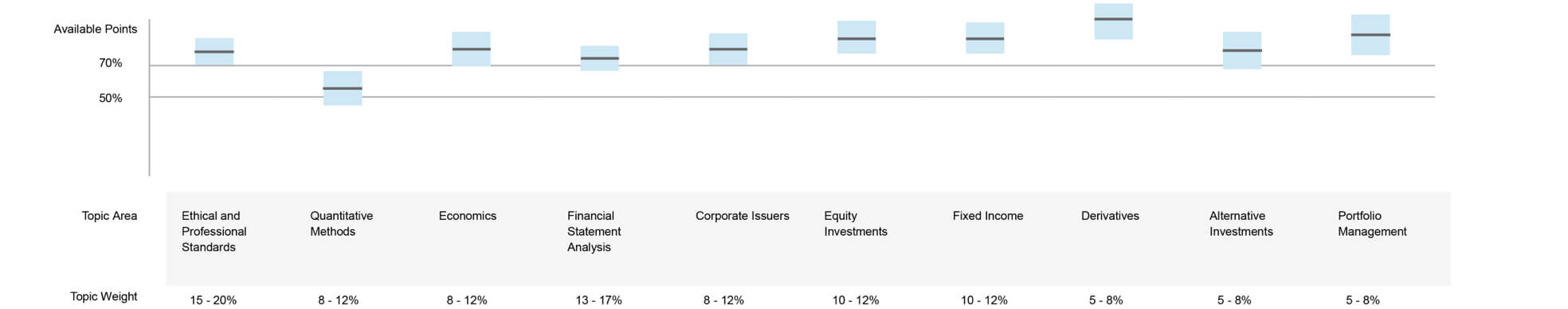

Performance by Topic Area:

The chart above uses the same conventions for score and potential range of scores (solid line and blue box), for each topic. Rather than 10th and 90th percentiles, the second chart shows lines for scores of 70% and 50% of available points for each topic. The Institute considers a score of 70% or higher sufficient mastery of the topic, and a. candidate who scores above the 70% line on most topics can expect to pass the exam. Scores between 50% and 70% represent areas for light improvement, and below 50% areas for major improvement. The results in this chart show possible improvement needed in the quantitative methods topic, although all other topics are favorable.

The ethics adjustment plays a role in the result. If a candidate’s overall score is very close to the MPS, then the score on the ethics section is used to determine whether or not the candidate passes or fails the exam. That, in addition to the heavy weight of the ethics section, makes it the most critical subject.

How should you use this report if you pass?

Before even looking at the score report, take a moment to appreciate the fact that you passed the exam. This is a major accomplishment, and you should enjoy it.

A passing score report on level 1 can give you useful hints on how to improve your performance on level 2. The level 2 exam has all the same topics as level 1, with similar weights. Ethics has a slightly lower weight (10-15% in level 2 vs. 15-20% in level 1) and Portfolio Management has a slightly higher weight (10-5% in level 2 vs. 8-12% in level 1). Although the topics are the same, the material in level 2 goes into deeper detail within each topic. For instance, the level 1 FSA has one LOS on defined benefit and defined contribution plans, while level 2 dedicates an entire learning module to that and related concepts. As you begin studying for level 2, review your level 1 results and note your weak areas. As you study, pay extra attention to the topics and concepts in level 1where you felt less confident.

How should you use this report if you fail?

The results report of a failed exam should serve as a guide for where to put more effort when you regroup and take the exam again. Make note of the subjects where your blue line fell below 70%, and especially below 50%. Keep those topics in mind and make sure to devote extra study time to them next time. A topic in the report that has an especially wide score box suggests you have greater potential for improvement in that area. This is low hanging fruit to improve your score.

Think back to exam day and try to remember the questions themselves. Were there concepts you found especially difficult, or you struggled to remember? Note any part of the material you felt you could have studied more the first time around. Also, don’t neglect the topics where you did well last time. Every correct answer on the exam is worth as much as every other correct answer.

Remember the exam curriculum changes every year. If you plan to retake the exam in the following calendar year, be sure to note the changes in the curriculum from your last exam and pay close attention to your previous CFA results report. Above all, don’t get discouraged if you fail. Many smart candidates fail exams, pass them the next time around, and go on to earn a charter. In fact, data from the Institute states that four in five CFA charter holders fail at least one exam on their way to the charter. Bottom line, this is a marathon, not a sprint, and failure is just a step on your path to success.

Find MBA Programs Matched to Your Interests

Explore our featured business schools to find those that are looking for students like you.

Top Online MBA Programs

On a mission to increase your salary? Our Top 50 Online MBA ranking is based on academics, career outcomes, tech platforms, and more.

Best Career Prospects

Find out which schools have the best track records for getting students jobs—and the highest starting salaries.

Top Schools for Entrepreneurship

Ready to build your own business from the ground up? Check out these 50 graduate programs.