SPONSORED BY CITIZENS

Hot take: paying for college includes more than just covering tuition. As you gear up and start packing for your move to school, expenses can start to get real. If you’re noticing a difference between the total cost of attendance and what your financial aid offer covers, you may need to find other options to help you pay for school. The Princeton Review and Citizens are here to help you find a way to compare what you’ll owe to what you’re being offered, and to come up with a game plan to bridge the gap before your first college bill arrives.

Here are four steps to build that plan and put it into action:

Step 1. Create a detailed college budget.

- Write down the costs you calculated for everything beyond tuition:

- Room and board (meal plans are often mandatory for first-year students)

- Fees (club memberships, facility usage, parking)

- Transportation (local and visiting home)

- Entertainment (movies, sports, restaurants, concerts)

- Note: If you’ll be living on campus, room and board is likely outlined as part of your expenses in your financial aid offer letter. Books and supplies are separate costs, and may be estimated in your letter or on your school’s website.

- Make sure you account for location and season—food, concerts, or sporting events might have a different price tag where you live now versus where you’re going. And if you’re traveling during a holiday or break, those costs may go up (buy a ticket earlier, if you can).

- Check the calendar for school breaks and plan your costs accordingly. Many schools offer short semester breaks in both Fall and Spring , including a break at Thanksgiving, winter break over the holidays, and spring break. (Will you go home? Travel elsewhere? Keep in mind dorms and food halls may be closed during breaks.)

- Do you plan to study abroad? Tuition, room and board, and travel costs may be different for a semester or year off-campus.

- Are you planning to make payments on any private loans while you're in school? Be sure to account for any monthly payments you might decide to make while still in school.

TIP: For parents, talking with your kids about paying for college can be tough. Here are 5 Tips for having the college money talk with your kids.

Step 2. Confirm how much aid you’re being offered.

- Compare the total aid you are being offered against the total cost of attendance you budgeted in Step 1. Chances are, your costs will exceed the aid offered, particularly when you factor in lifestyle expenses for food, entertainment, and travel.

- Be sure you understand the type of aid being offered (loans, grants, work study), and that any loans will need to be paid back over time with interest.

TIP: Here’s a refresher on understanding loan types and tips from Citizens about reading your financial aid letter.

Step 3. Tally up any other sources of income.

- Outside of your financial aid offer letter, what other income will you have during college? For instance, you might be getting:

- Financial support from your parents or relatives

- Part-time jobs, including summer work (not work-study, which would be part of your financial aid package)

- Grants or scholarships not included in your financial aid offer letter

TIP: Still looking for scholarship money? Review these ideas for finding college scholarships. You can also enter to win the $15,000 Citizens Scholarship—it’s fast and free to apply.

Step 4. Exhausted all of your funding options? Consider a private loan to fund the gap.

- If you’ve thought through all the options to pay for school, including “free” money from grants or scholarships and “earned” money from employment, but you’re still coming up short, consider a private loan to cover the rest.

- Educate yourself about student loan interest rates and how they work. Things to keep in mind: fixed versus variable rates, making interest-only payments during school vs. deferring until graduation, and adding a co-signer (which means you’re more likely to get approved for your loan, with a lower rate).

- If you are looking for private loans, shop around for the best rate and repayment options. Understand any incentives or discounts available to help streamline your costs, including having another account at the bank or institution, setting up automated payments, and more.

TIP: Citizens offers a Student Credit Builder Loan that allows you (or your cosigner, like your parents) to make interest-only payments on your loan throughout school. This helps reduce the amount you owe when you graduate AND can help you build good credit. Which could come in handy when you're looking to rent your own apartment, get some new wheels, or even buy a house. Citizens has 40 years of student-lending experience for private student loans. See their loan options and rates.

If you’re interested in becoming a partner of The Princeton Review and sponsoring educational content, click here for details.

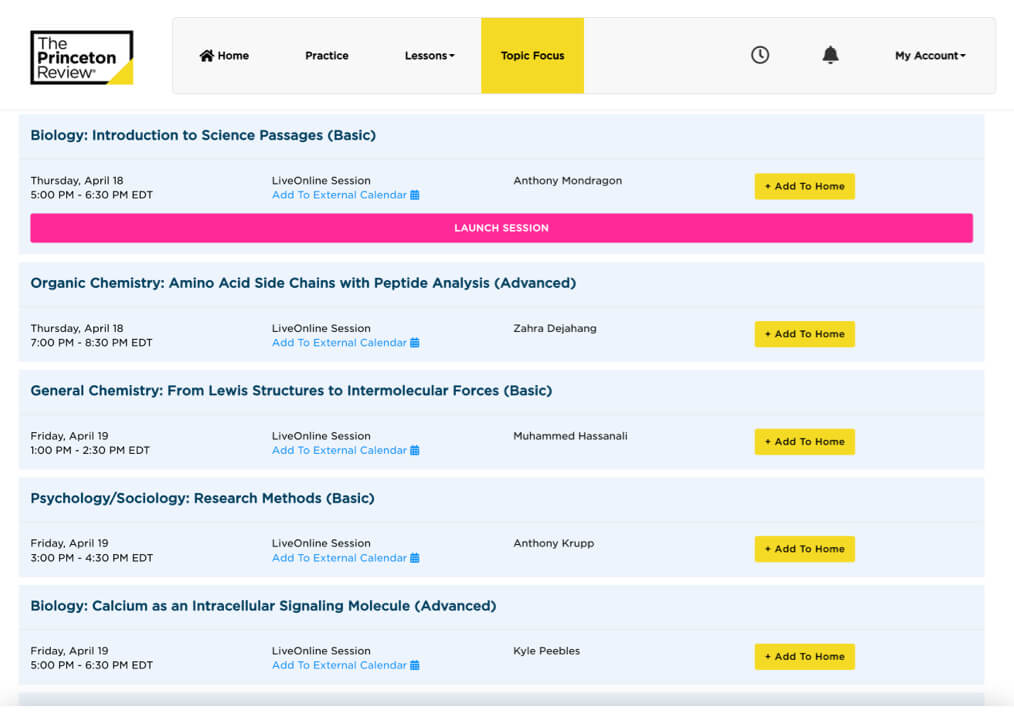

Explore Colleges For You

Connect with our featured colleges to find schools that both match your interests and are looking for students like you.

Get Started on Athletic Scholarships & Recruiting!

Join athletes who were discovered, recruited & often received scholarships after connecting with NCSA's 42,000 strong network of coaches.

Best 389 Colleges

165,000 students rate everything from their professors to their campus social scene.